Supply Levels Improve in January

After three years of tight inventory, January saw a welcome increase in supply, with 3,639 units available. This marks a 70% year-over-year gain, though levels remain below the typical 4,000 units seen in January. Inventory growth was observed across all property types, with apartment-style condominiums experiencing the largest gains.

Ann-Marie Lurie, Chief Economist at CREB®, noted, “Supply levels are expected to improve this year, contributing to more balanced conditions and slower price growth. However, not all property types are seeing the same supply adjustments. Detached, semi-detached, and row properties remain tight, while apartment condominiums show signs of excess supply in higher price ranges.”

The months of supply rose to 2.5 months in January, improving from last year’s one-month level but still considered low for winter. Semi-detached properties saw under two months of supply, while apartment-style units reached 3.5 months.

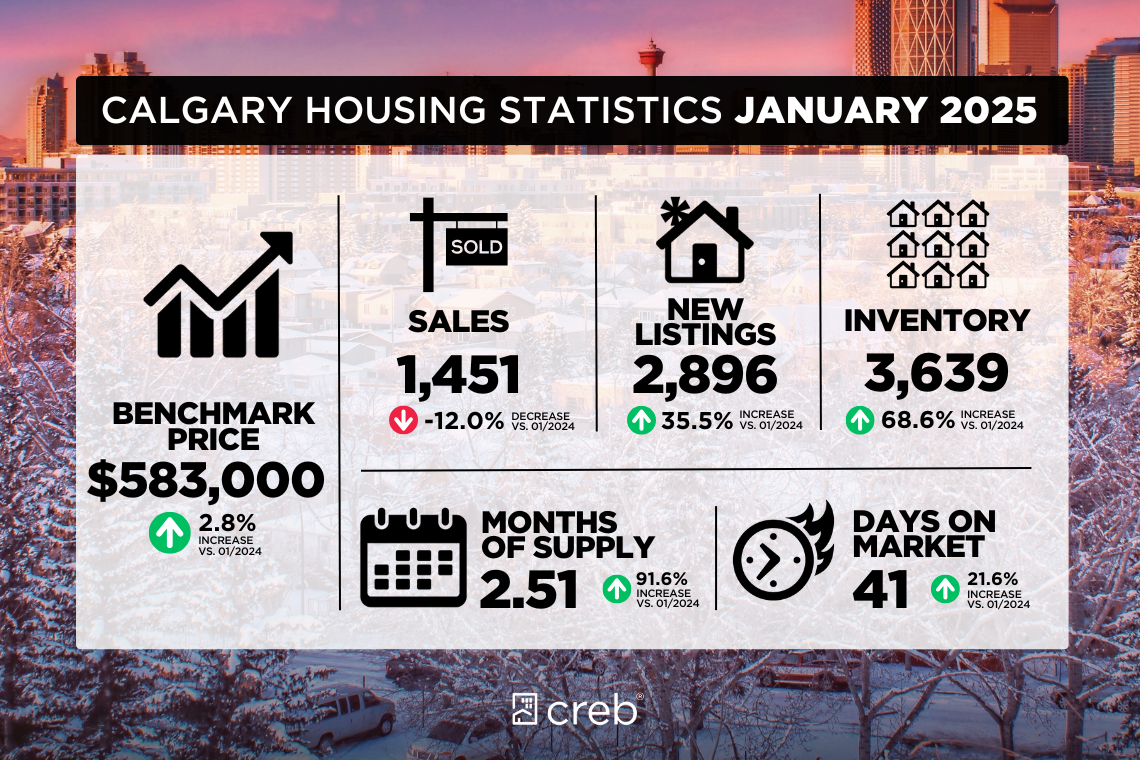

New listings outpaced sales, with 2,896 new listings and 1,451 sales in January. Sales were down 12% year-over-year but remained nearly 30% higher than historical January averages. The total residential benchmark price stood at $583,000, stable from December and 3% higher than last January.

Market Breakdown by Property Type

Detached Homes

New listings for detached homes increased by 29% to 1,228 units, driven by properties priced above $600,000. Sales slowed to 674 units, aligning with long-term trends. Inventory gains were supported by the rise in new listings, though the 1,448 available units remain 27% below traditional January levels. The months of supply sits at just over two months.

Market conditions vary across city districts, with more balanced conditions emerging in the City Centre and North East. The unadjusted benchmark price reached $750,800, up 7% from last year.

Semi-Detached Homes

New listings outpaced sales, leading to higher inventory. While semi-detached homes account for a smaller market share, January sales improved over last year, keeping months of supply just under two months. Districts like the City Centre, North East, and West reported near or above three months of supply, while other districts remained below two months.

The unadjusted benchmark price was $673,600, slightly lower than last month but up over 8% from last year. Areas with higher supply saw minor price declines, while other districts experienced stable or modest growth.

Row Homes

January saw a surge in new listings, pushing inventory to 589 units—more than double last January’s near-record low. Supply levels are now closer to long-term trends, with months of supply rising above two months.

While improving supply has reduced price pressure, the impact varies by district. The unadjusted benchmark price was $444,900, down slightly from last month but nearly 5% higher year-over-year. The largest monthly price decline occurred in the North East district.

Apartment Condominiums

Sales slowed to 370 units, while new listings climbed to a record-high 922 units for January. The resulting inventory increase pushed months of supply to 3.5 months—higher than the past three years but well below the pre-pandemic nine-month average.

The increased supply has softened prices over the past five months. The unadjusted benchmark price stood at $331,400, slightly lower than last month but up 5% from last year. The most significant monthly price declines were seen in the North, West, and South districts.

Regional Market Trends

Airdrie

Sales remained consistent with last month and last year, both exceeding historical trends. A rise in new listings helped improve inventory, keeping months of supply above two months for the fifth consecutive month. The unadjusted benchmark price in January was $537,300, down slightly from December but nearly 4% higher than last year.

Cochrane

Cochrane experienced higher new listings and inventory, with 104 new listings and 71 sales in January. Inventory reached 156 units, marking an improvement over the past three years but still below long-term averages. Months of supply have remained above two months for five consecutive months, helping ease price pressures. The unadjusted benchmark price was $565,900, down slightly from last month but up nearly 5% year-over-year.

Okotoks

Unlike Airdrie and Cochrane, new listings in Okotoks remained low compared to last year. While inventory levels improved slightly, the 68 available units in January remain well below pre-pandemic levels. The limited supply has been a key factor in price increases since 2021. The unadjusted benchmark price reached $614,900, showing a small monthly gain and a nearly 5% increase from last year.

Final Thoughts

January 2025 saw a shift toward more balanced conditions, with rising supply helping ease market pressures. While demand remains strong, particularly for detached and semi-detached homes, increased inventory is expected to moderate price growth in the months ahead.

For buyers, more options are becoming available, particularly in the apartment condominium market. For sellers, pricing strategy and market timing will be key as conditions continue to evolve. Stay tuned for next month’s update!